The effect of IMF on world economy:

The Effect of the International Monetary Fund (IMF) on the World Economy

Introduction

The International Monetary Fund (IMF) is one of the most influential institutions in the global economic architecture. Established in 1944 during the Bretton Woods Conference, its original aim was to promote international monetary cooperation, facilitate the expansion and balanced growth of international trade, and contribute to high levels of employment and real income. Over the decades, the IMF has evolved into a central player in the stabilization and restructuring of economies worldwide.

Its influence extends from shaping macroeconomic policies of debtor countries to playing a crucial role in global financial crises. Yet, the IMF has also faced criticism for imposing austerity, promoting neoliberal policies, and undermining national sovereignty. This article explores the multifaceted impact of the IMF on the global economy by analyzing its role, successes, criticisms, and ongoing challenges.

Origins and Mandate of the IMF

The IMF was founded with 44 member countries and has grown to include 190 as of 2025. Its core objectives include:

-

Promoting international monetary cooperation

-

Ensuring exchange rate stability

-

Facilitating balanced growth of international trade

-

Providing resources to members facing balance of payments crises

The IMF achieves its objectives through a triad of functions:

-

Surveillance: Monitoring global economic trends and advising member states on macroeconomic policies.

-

Financial Assistance: Offering financial support to countries with balance of payments problems.

-

Technical Assistance and Capacity Development: Providing expertise and training in areas such as fiscal policy, monetary policy, and financial regulation

Positive Impacts of the IMF on the World Economy

1. Crisis Management and Stabilization

The IMF has played a critical role in stabilizing economies during crises. Notable examples include:

-

Asian Financial Crisis (1997–1998): The IMF intervened in South Korea, Indonesia, and Thailand, providing emergency loans to stabilize collapsing currencies and banking systems.

-

Global Financial Crisis (2008): The IMF mobilized unprecedented resources to support emerging economies facing liquidity shortages.

-

COVID-19 Pandemic (2020–2022): The IMF provided rapid disbursing emergency financing to nearly 100 countries.

Such interventions helped restore confidence in financial markets, prevented deeper recessions, and facilitated the return to economic normalcy.

2. Monetary and Fiscal Policy Guidance

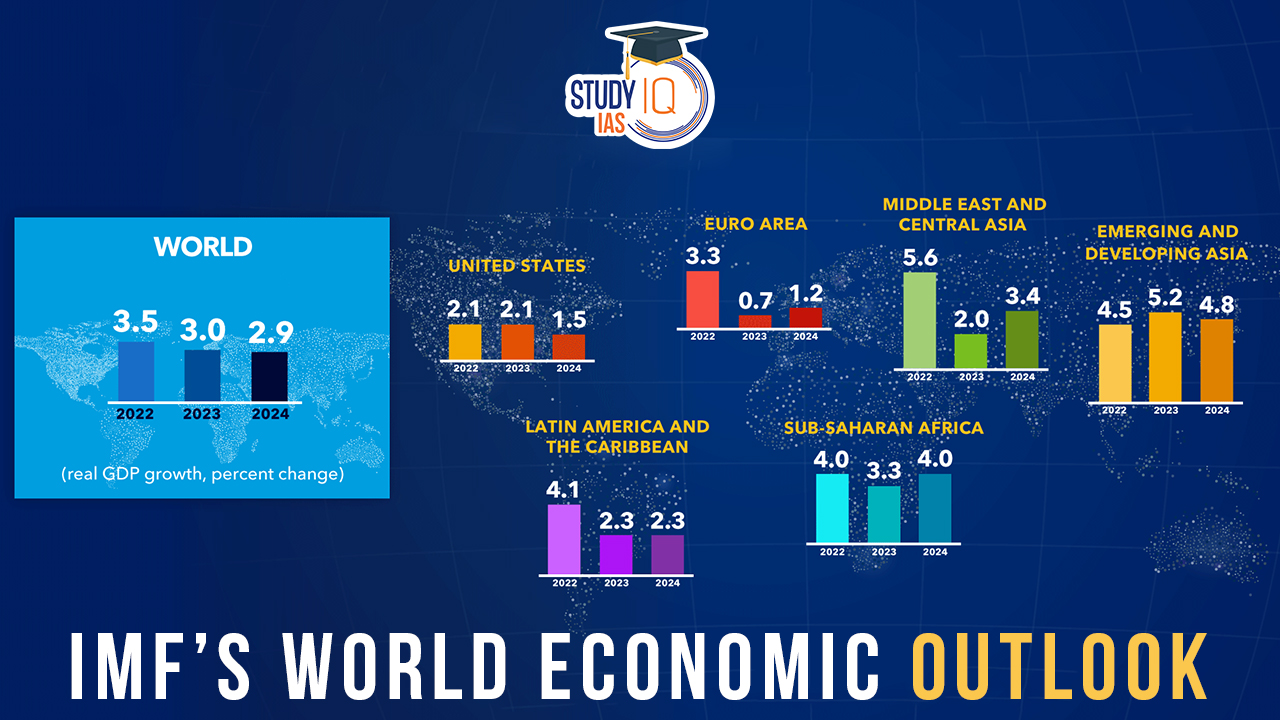

Through its surveillance role, the IMF provides crucial insights into macroeconomic trends. Its flagship publications, such as the World Economic Outlook and Global Financial Stability Report, offer forecasts and policy advice that inform decisions by governments, central banks, and investors.

The IMF’s policy advice has contributed to structural reforms, improved fiscal discipline, and strengthened monetary frameworks in many developing countries.

3. Debt Sustainability and Restructuring

The IMF plays a vital role in debt sustainability analysis and sovereign debt restructuring. For countries like Argentina, Greece, and Zambia, IMF involvement was instrumental in facilitating negotiations with creditors. Its frameworks offer credibility and technical expertise, essential in complex debt negotiations.

4. Capacity Development and Technical Assistance

Beyond loans, the IMF invests in capacity development through training and advisory services. These efforts help strengthen institutions, enhance transparency, and build resilience in low- and middle-income countries.

For example, in African countries, the IMF has supported improvements in tax administration, central bank independence, and anti-corruption frameworks, which are foundational for long-term development.

Criticisms and Controversies

Despite its achievements, the IMF has attracted criticism from scholars, policymakers, and civil society. Several recurring themes include:

1. Austerity and Social Costs

A common critique is that IMF-imposed conditions—particularly austerity measures—exacerbate poverty and inequality. Structural Adjustment Programs (SAPs) in the 1980s and 1990s often required cuts in public spending, removal of subsidies, and privatization.

In countries like Ghana, Bolivia, and Zambia, these policies led to reduced access to health, education, and social services, sparking protests and long-term discontent.

The case of Greece (2010–2018) is instructive. Under IMF-EU-ECB supervision, Greece implemented severe austerity, resulting in high unemployment, economic contraction, and social unrest, even as fiscal targets were met.

2. Loss of Sovereignty

When countries accept IMF assistance, they often have to adopt policy reforms dictated by the Fund. Critics argue this undermines democratic decision-making and national sovereignty.

In Latin America, particularly Argentina, IMF conditionalities have been perceived as externally imposed neoliberal blueprints that did not align with domestic priorities.

3. One-Size-Fits-All Policies

The IMF has often been accused of promoting a standardized economic model emphasizing liberalization, deregulation, and fiscal discipline, irrespective of local context. This approach has been less successful in fragile states or countries with unique political-economic conditions.

For example, trade liberalization policies did not yield expected benefits in many Sub-Saharan African economies, as they lacked the industrial base to compete globally.

4. Governance and Representation

The governance structure of the IMF is skewed in favor of wealthy countries. Voting rights are based on quotas, with the U.S., EU, and other G7 members holding disproportionate influence. Efforts to reform quotas to give more voice to emerging economies like China, India, and Brazil have progressed slowly.

This asymmetry has raised concerns about legitimacy and accountability, particularly among developing nations that are frequent IMF clients but lack proportional decision-making power.

The IMF and Developing Economies

The relationship between the IMF and the developing world is complex and often contentious. While the Fund provides needed liquidity and technical support, its policy prescriptions have sometimes clashed with development goals.

Case Study: Sub-Saharan Africa

Many African nations turned to the IMF during the debt crises of the 1980s. IMF programs focused on macroeconomic stabilization, often at the expense of growth-oriented investments.

-

Pros: Inflation control, improved fiscal discipline, currency stabilization.

-

Cons: Lower public investment in health and education, increased reliance on foreign aid, and greater vulnerability to global shocks.

More recently, the IMF has revised its approach, incorporating social spending safeguards and acknowledging the importance of inclusive growth. The Enhanced General Data Dissemination System (e-GDDS) and Poverty Reduction and Growth Trust (PRGT) are examples of efforts to align IMF programs with developmental needs.

The IMF and Global Financial Governance

The IMF is a cornerstone of the international financial system. It collaborates with the World Bank, Bank for International Settlements (BIS), G20, and Financial Stability Board (FSB) to monitor risks and coordinate policy responses.

1. Surveillance and Early Warning

The IMF’s surveillance functions include monitoring global imbalances, currency misalignments, and capital flows. It helps identify vulnerabilities that could trigger crises, thus enhancing financial stability.

2. Policy Coordination

In an increasingly interconnected world, coordinated responses are essential during global shocks. The IMF plays a crucial role in aligning fiscal and monetary responses among major economies during crises, such as the coordinated stimulus during the 2008 crash or the SDR allocations in response to COVID-19.

Reforms and the Future of the IMF

To remain effective, the IMF must adapt to evolving global dynamics. Key areas for reform and innovation include:

1. Quota and Voting Reform

Developing countries seek greater representation in IMF decision-making. Realigning quotas to reflect the changing economic weight of emerging markets is crucial for legitimacy and fairness.

2. Climate Change and Sustainable Development

The IMF has increasingly recognized the macroeconomic implications of climate change. It is now developing climate-related risk assessments and advising countries on carbon pricing, green investment, and energy subsidies.

3. Digital Finance and Technology

With the rise of fintech, digital currencies, and decentralized finance (DeFi), the IMF is exploring how these innovations impact monetary sovereignty, financial stability, and capital flows.

4. Social Protection and Inclusive Growth

Recent programs emphasize the need for safeguarding social spending and promoting gender equity, labor market participation, and poverty reduction as essential components of sustainable development.

Conclusion

The International Monetary Fund has had a profound impact on the world economy. It has served as a stabilizer during crises, a source of policy guidance, and a catalyst for institutional reform. Its contributions to economic stability, debt management, and capacity building are undeniable.

However, the IMF's legacy is also marred by controversies over austerity, policy conditionality, and governance imbalances. For many countries, IMF programs have been a double-edged sword—offering short-term relief but at a long-term social and political cost.

As the global economy confronts new challenges—ranging from climate change to geopolitical fragmentation—the IMF’s role will continue to evolve. To remain relevant and effective, it must become more inclusive, responsive to local contexts, and oriented toward sustainable development.

In sum, the IMF is both a symbol of international economic cooperation and a reflection of its contradictions. Its future success depends on its ability to reform itself, rebuild trust among developing nations, and address the structural inequalities that continue to define the global financial system.

Comments

Post a Comment